Selling Snipcart: Part Two

I don’t want to sugarcoat this piece into a fairy tale. Of course there were frictions. Georges, for one, did not want to sell the business.

→ TechCrunch post

→ Part One

→ Part Two

→ Part Three

The story that follows is told from my perspective. Everyone mentioned in this post has read and approved it.

All things considered, negotiations went well.

I struggled with two elements:

- Being stuck between two negotiation fronts.

- Balancing emotions, friendship, and business.

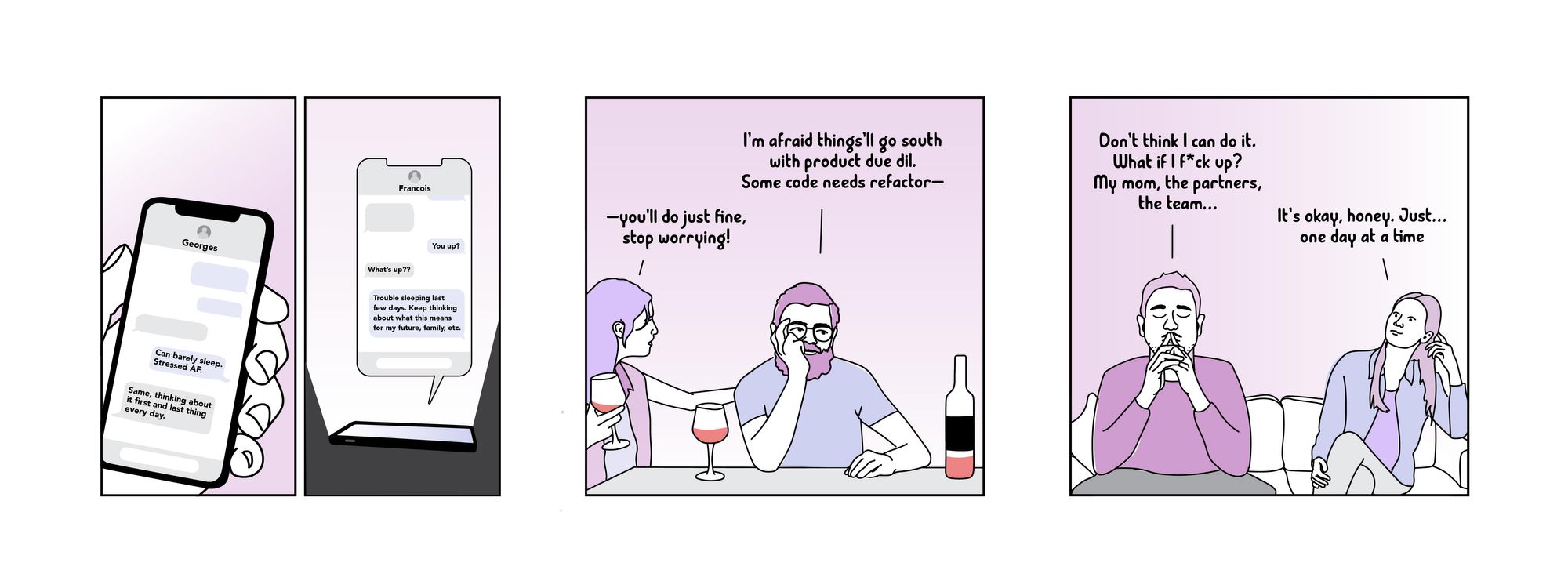

Some people draw a clear line between friendship and business. I can’t. And the four of us were partners, sure, but also friends.

I don’t want to sugarcoat this piece into a fairy tale. Of course there were frictions. Georges, for one, did not want to sell the business. To this day, he’ll tell you he would’ve preferred not selling. For some things that happened or could’ve happened, we may never see eye to eye. I can only hope our friendship emerges from this whole thing unscathed.

Early on, buyers identified Georges and Vincent as “non-operating partners.” Owners no longer heavily involved with operations and exiting after the deal. Charles and I were the opposite.

For the record: this isn’t to say Georges and Vincent weren’t crucial to Snipcart’s success. They were. For years, they invested time, money, energy. They took risks, trusted Charles and me, and were patient. However, these last years, it’s also true that they were significantly less involved in the running and scaling of the business.

It wasn’t long before we realized the four of us weren’t negotiating the same deal. Georges and Vincent were leaving, Charles and I were staying. From an individual POV, it’s a different story.

Georges and Vincent have always been entrepreneurs. Willing and able to take risks, back early startups, launch ambitious projects. Most of these initiatives shared a proximity element: physically or logistically close to the guys. They had a significant amount of control over them. They were often betting on themselves—I’ve always admired them for it!

Their position in this deal was different. If they agreed to lots of vesting, long-term opportunities, the project’s outcome would be very distant from them. At first, I didn’t understand that. I was hurt that they didn’t want to bet on Charles and I’s impact at Duda. Or that they weren’t interested in getting closer to Duda as a high-potential company. They were aiming for as clean an exit as possible.

Today I understand, or at least I think I do. However, when negotiations began, I could only respect the outcome they wanted and try my best to make everyone happy. So I asked for a cleaner, shorter exit for them, and got it. Duda were acting in good faith, also trying to make everyone happy. At that point, Charles and I naively went along with the highly-vested deal Duda offered us in the beginning.

Enter the tax experts

Two meetings were all we needed to grasp how much money would go to taxes. It was a lot, and I honestly had not even thought about it up until then. Our fiscal reality shocked me into re-evaluating Charles and I’s yearly earnings. I talked with peeps some more. The wealthier ones advised me not to sell, to keep growing and holding on to the company’s value. The less wealthy ones advised me to take the money and run. Now, this isn’t a judgment, only an observation from my experience. I, for one, was confused. People I highly respected were giving me contradictory advice.

A couple of weeks after speaking with tax experts and entrepreneurs, I refined my decision framework. Georges supported me in this process. My considerations:

- Several mergers & acquisitions fail.

- Many factors aren’t under my control (hierarchical relations, emotionality, unplanned changes, market movements).

- M&A integrations go slowly at first. At least a year before really knowing where both companies stand.

- If I don’t have a majority of my shares’ value in pocket at the time of leaving, I’ll be unhappy.

I concluded with:

- I need a majority of my value at the end of year one to not regret selling Snipcart.

Again, this is highly personal. You can see from my reasoning that I’m not the most risk-tolerant person. This conclusion is only the result of my own story, anxiety, and ambitions. Not a prescriptive framework for founders looking to sell.

I calculated new numbers. Charles was all-in. Georges & Vincent didn’t mind, even though it could be a deal-breaker. I gave the four of us 24 hours to sleep on it. Time didn’t change our minds.

Now the tricky thing with this conclusion was sharing it with Itai, Duda’s CEO. The delta between his initial offer for operating partners and our new ask was vast. It involved more liquidity upfront.

The ask

I told Itai we needed to talk. We hopped on a call.

Stress soared. I became more aware of my English accent. Stalled a bit, then went for it:

“Listen, I hate to do this now, but we talked with fiscalists, and our mindset has changed regarding Charles and I’s core terms.”

He pressed me to go on.

I did. I shared all my considerations and then some. He took it relatively well—he’s a cool, composed guy. Never seems off-balance. He replied:

“Listen, I understand you’re trying to manage your own risks, but I must do the same. Your ask signals a potential desire not to commit long term. We can’t have you and Charles leaving early post-acquisition. You’re both key to this project.”

I nodded. He went on:

“I’ll see what I can do to throw more early value your way, but I won’t be able to meet exactly your ask.”

With shaky confidence, I restated:

“Again, I’m sorry to ask for this change at this point. New information surfaced, and that’s where we stand. Charles and I are really excited about teaming up with Duda for Snipcart’s next chapter. I can only give you my word on that. But like I’ve been telling you from the start, if this deal doesn’t work, I won’t be devastated. I’ll be disappointed for a bit, then happily go back to building our business.”

We closed on this uncertain note.

A week passed. Then a new offer landed via email.

We did the math. It was a very generous offer and showed lots of good faith. However, it just didn’t meet our final decision criteria (I need a majority of my value at the end of year one to not regret selling Snipcart).

I told the partners I wanted to decline the offer. Charles thought about it, then hesitantly agreed. Georges and Vincent gave us the green light to decline. I’m still thankful for their support at that moment. I think they had lots of faith in Snipcart’s future under Charles and I’s leadership, too. They knew other opportunities might show up.

Again, I gave everyone 24 hours to sleep on it. Woke up to four green lights still.

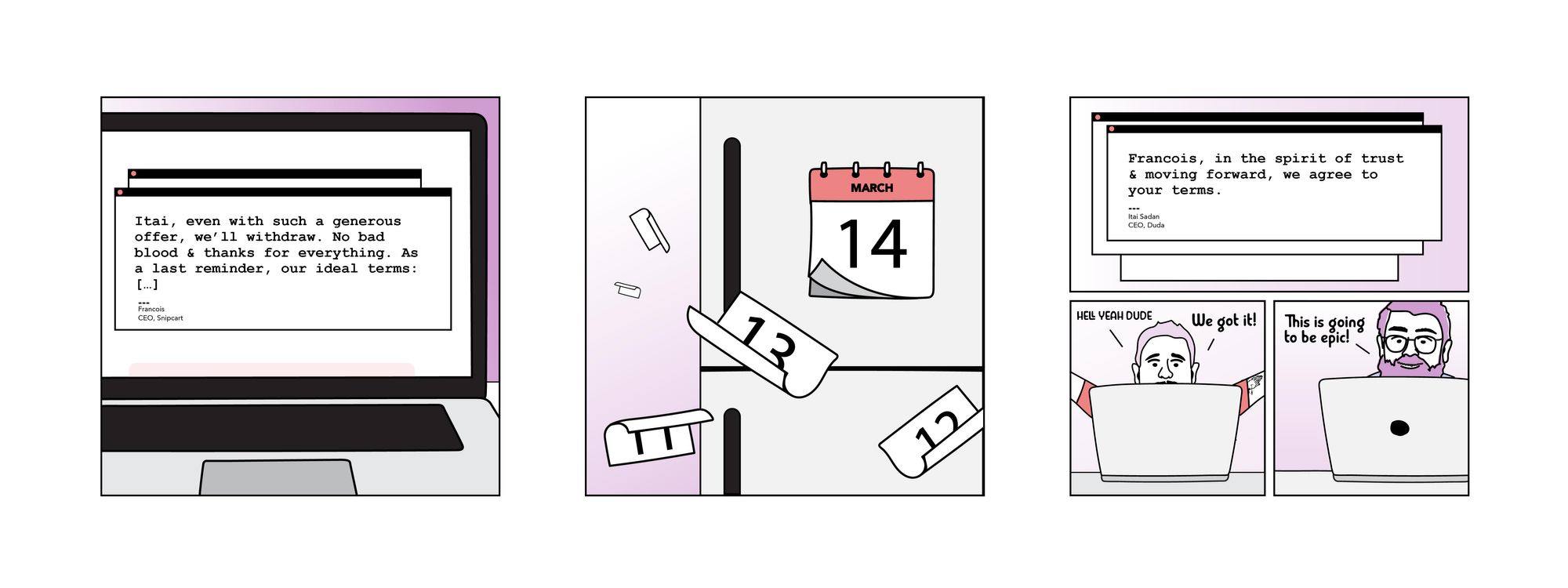

And so I wrote the most fucking stressful email of my entire life.

I thanked Itai for his time, trust, and teachings. I emphasized there was no bad blood on our end at all. I proposed helping them buy another e-commerce company even. But I explicitly declined the offer and said we’d be removing ourselves from the deal. As a last-ditch effort to keep the ball rolling, I reminded him of the numbers we needed to go all-in with the acquisition.

I pressed send. Potential timelines flashed before my eyes. I got hot. My mind started spinning. Had I just fucked up the most amazing opportunity of my life? Had I just fucked up my financial future, my mom’s retirement, my business’ success? As the unsend button disappeared, so did my confidence. I sent a screenshot to the guys. Closed my laptop. Went outside.

Four days passed—four days of radio silence.

The guys were asking me twice a day if Itai had answered. I kept refreshing my inbox.

Then the reply came.

Francois,

In the spirit of cooperation and moving forward, we agree to your terms. […]

I cried out loud with relief. I called Charles, screaming the news.

Immediately after, I replied to Duda, saying how grateful we were and how motivated we were for the next steps.

Next step was due diligence AKA Charles’ most stressful month in years. 😂

Due diligence

One cold winter morning, we received a small email with a big attachment:

→ 30 pages list of items to deposit in the DATA ROOM.

“The data room” is a fancy term for secure online portals offered by business lawyers. It’s where you need to drop all of the documents to verify by the acquirer.

With gleeful enthusiasm, we came up with a huge TODO. We assigned different items to the four of us: Georges and Vincent took care of accounting, finances, legal. I owned the people part and bits of the product. Charles started on the product.

We soon realized he’d need help with technical deep dives & communications.

And that, my friends, is when we first breached this deal’s secret: by telling Francis, our lead developer, and asking for his help with due diligence.

Charles and I were pretty nervous. Announcing it to Francis was a test drive of telling it to the whole team. We weren’t sure how he’d react!

To our relief, he took it very well. He raised some early worries that helped us better communicate the full announcement later on. He was all in with helping us with due diligence and sharing in that heavy secret for a while.

I won’t burden you with all the details here. Still, here are some example questions the buyer wants answered during due diligence:

- How trustworthy and talented is the team in place?

- Why are people leaving? Joining?

- How scalable is the platform?

- What needs improvements in product and process?

- Is the business solvent, debt-free?

- Are the founders 100% legally owners of the cap table?

- Any pending legal actions against the company?

And on and on and on.

To our surprise, the due diligence process went faster than planned. Charles was relieved he didn’t mess up the deal with his old code from 2013. :troll: A bit more than a month, and we were done. With core deal terms set.

We were already talking about roadmap, announcements, integrations, etc.

Little did we know the LAWYERS weren’t quite finished yet.

It's a wrap for Part Two!

Read the final Part Three here